It has been a week of mixed results for the DXY. The index closed with a bullish weekly candle but failed in its effort to reclaim the key psychological 100 level. NFP was not as bad as expected and this further supported the risk-on shift that was evident on Thursday. This US$ weakness could help to support the likes of the Aussie and Kiwi so Forex traders should keep them in mind for potential trading opportunities. Remember, as posted during the week, traders need to choose their battles most judiciously in the weird market times.

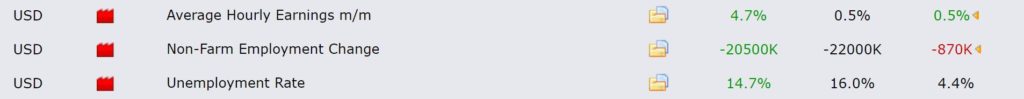

NFP result: the worst unemployment figures since the Great Depression but the results were cheered as they weren’t as bad as expected!

DXY

DXY monthly: this chart hasn’t updated for Friday but the feature I want you to note is the importance the key 100 level. This does seem to be a major reaction zone and the index seems to spend more time below this threshold than above:

DXY weekly: a bullish weekly candle but the index could not hold above 100, however, note the continued low momentum:

DXY daily: watch for any momentum trend line breakout:

DXY 4hr: a sharp dip late Friday:

EURX

EURX weekly: a bearish weekly candle, but, still very little momentum:

EURX daily: watch for any momentum trend line breakout:

EURX 4hr: the 110 seems to be the level to watch:

FX Index Alignment:

- EURX: is at the top edge of the 4hr Cloud but below the daily Cloud so not aligned and prone for potential choppy EUR$ price action.

- USDX: is below the 4hr Cloud and in the daily Cloud so not aligned and prone for potential choppy USD$ price action.

Calendar: watch US CPI to start the week and US Retail Sales on Friday: