This page contains some numerous examples of charts showing Fibonacci retracement activity and, especially, the popularity of the 61.8% level (click on images to enlarge).

This article follows on from two previous ones posted on this site that give more detailed information about applying Fibonacci retracement to charts and these can be found here and here.

Example DXY February 2022: note where the index stalled! Right at the 61.8% Fibonacci!

Example GBP/JPY November 2021: note where the currency pair retraced to here! The 61.8% Fibonacci!

GBP/JPY 4hr: a pullback to the 61.8% Fibonacci:

Example FZO.ASX September 2021: this took its time after the wedge breakout in mid 2020 but the 61.8% Fibonacci was eventually reached!

FZO weekly: a mid 2020 wedge breakout:

FZO weekly: the 61.8% Fibonacci target reached mid 2021:

Example FBU.ASX September 2021: check where price action paused after this bullish wedge breakout:

FBU weekly: paused at the 61.8% Fibonacci:

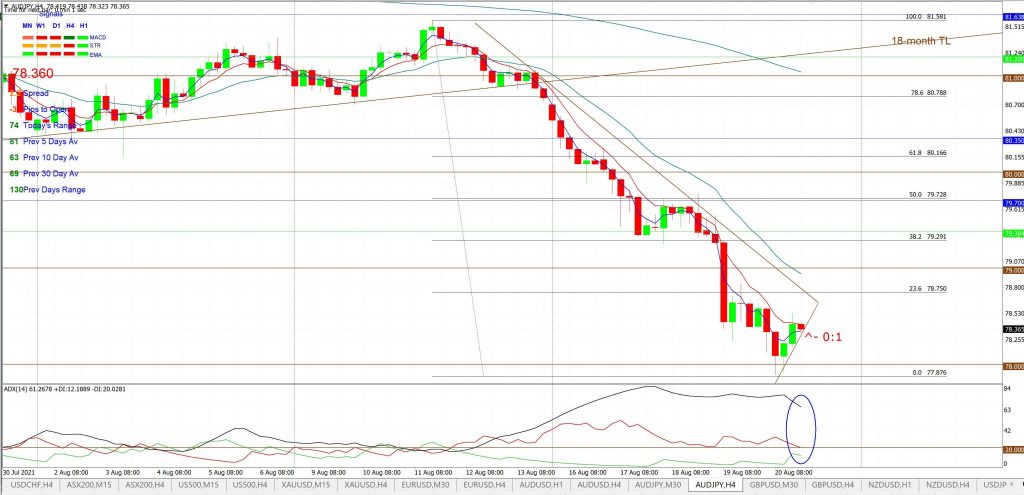

Example AUD/USD and AUD JPY Aug 2021: both these Forex pairs gave great trend line breakouts from patterns profiled in the weekly update on August 22nd 2021. Both moved up to the vicinity of the 61.8% Fibonacci before pausing:

AUD/USD 4hr: chart from weekend update of 22nd Aug 2021:

AUD/USD 4hr: note the move up to the 61.8% Fibonacci and then pause:

AUD/JPY 4hr: chart from weekend update of 22nd Aug 2021:

AUD/JPY 4hr: note the move up to the 80 S/R near the 61.8% Fibonacci:

Example GBP/USD July 2021: a great example of watching for a trend line breakout and, then, using the 61.8% Fibonacci as a target. This trend line breakout trade gave up to 170 pips!

GBP/USD 4hr: chart posted in weekend update from July 25th:

GBP/USD 4hr: chart after a TL b/o and reach to the 61.8% Fibonacci::

Example Bitcoin (BTC/USD) May 2021: BTC/USD was mapped in April and noted in a Tweet on April 19th. The 61.8% Fibonacci was down near $30,000 and this was noted as a potential level to watch for any test if there was any break of the support trend line. Note how this was tested to the T just one month later.

BTC/USD weekly: chart from April 19th Tweet:

BTC/USD weekly: chart from April 19th Tweet showing $30,000 in focus:

BTC/USD weekly: chart from test of the 61.8% Fib from May 20th Tweet:

Example Alcoa (AA) May 2021: This triangle breakout took about 7 months to complete but worked like clockwork. Price at the time of the breakout was $13.47 and the target of $40 was exceeded. That is almost a gain of 2 R or 196%!

AA weekly: a new triangle b/o in Oct 2020:

AA weekly: the 61.8% Fib target was reached in May 2021:

Example USD/JPY April 2021: The USD/JPY had been trading in a descending wedge for 4 weeks during April 2021. The wedge breakout triggered and the move peaked at the 61.8% retracement level before retracing:

USD/JPY 4hr: stalking this wedge for any b/o:

USD/JPY 4hr: the b/o move reached the 61.8% Fibonacci:

USD/JPY 4hr: note how price retraced after reaching the 61.8% Fibonacci:

Example NZD/USD April 2021: The Kiwi had been trading in a descending channel before finding support near 0.70. The channel breakout triggered on April 13th and the move peaked at the 61.8% retracement level:

Kiwi 4hr: new breakout on April 13th:

Kiwi 4hr: note how price reached the 61.8% Fibonacci before retracing:

Example: GBP/JPY April 2021: a descending wedge set up on the EUR/USD in April 2021 and the breakout target of the 61.8% Fibonacci was reached within a a few days for 200 pips:

GBP/JPY 4hr: chart from April 16th 2021:

GBP/JPY 4hr: chart from April 21st 2021 with 200 pip b/o move:

Example: EUR/USD April 2021: a descending wedge set up on the EUR/USD in early 2021 and the breakout target of the 61.8% Fibonacci was reached within a couple of weeks for 230 pips:

EUR/USD 4hr: descending wedge was brewing for a few weeks by April 2021:

EUR/USD 4hr: descending wedge target of 61.8% Fibonacci reached by 19th April 2021:

Example: Freeport McMoran FCX March 2021: This chart was posted in Dec 2019 and was revised before the eventual successful breakout. The 61.8% Fibonacci target was reached in early 2021:

FCX weekly: Dec 2019:

FCX weekly: March 2021:

Example: Soybeans ZS March 2021: This chart was posted in Dec 2019 and the breakout was a bit messy BUT the 61.8% Fibonacci target was reached in early 2021:

Soybeans weekly: Dec 2019

Soybeans weekly: March 2021:

Example: Century Aluminium CENX February 2021: This trend line breakout triggered in mid-2020 and the target was reached in March 2021:

CENX weekly: breakout triggered in mid-2020:

CENX weekly: breakout target of 61.8% fib reached early-2021:

Example: Westpac WBC February 2021: The 61.8% Fibonacci retracement target, near $24, was finally reached. Article first posted in May 2020 when price was $15:

WPC in May 2020: target for retracement move was $24:

WPC in March 2021: target reached:

Example: Galaxy Resources GXY February 2021: This Descending Wedge breakout took a long time but was eventually successful with the 61.8% Fibonacci target reached in January 2021. First Tweeted in early 2020:

GXY weekly: the wedge b/o triggered in early 2020:

GXY weekly: the wedge 61.8% Fibonacci target reached in Jan 2021:

Example ASX-200 February 2021: note how price action paused at the 61.8% Fibonacci:

ASX-200 4hr: this chart was posted on Monday 1st Feb:

ASX-200 4hr: note the test of the 61.8% Fibonacci::

Example Copper December 2020: note how price action paused at the 61.8% Fibonacci:

Example RUT v SPX December 2020: note how price action paused at the 61.8% Fibonacci:

Example AUD/USD October 2020: this 4hr chart of the USD/JPY was posted in my weekend analysis from September 27th. It only took a few days but the 61.8% Fibonacci was essentially reached:

AUD/USD 4hr: chart from weekend analysis of September 27th 2020:

AUD/USD 4hr: chart showing the move to the 61.8% fib level target:

Example USD/JPY September 2020: this 4hr chart of the USD/JPY was posted in my weekend analysis from September 20th. It only took a few days but the 61.8% Fibonacci was essentially reached:

USD/JPY 4hr: chart from weekend analysis of September 20th 2020:

USD/JPY 4hr: chart from analysis of September 24th 2020 showing move to the 61.8% fib level:

Example Gold August 2020: This triangle breakout on Gold triggered and pulled back to the 4hr chart’s 61.8% Fibonacci level.

Gold 4hr: chart with triangle in focus for any new TL b/o:

Gold 4hr: chart following TL b/o and pullback to the target 61.8% Fibonacci:

Example AAPL May 2020: Note where price action paused with the recent pullback! Right at the 61.8% Fibonacci:

AAPL weekly: the pullback paused right at the 61.8% Fibonacci level:

Example AUD/USD April 2020: Note where price action paused after this trend line breakout (click on image for larger view):

AUD/USD 4hr: chart from weekend analysis with a channel b/o trade idea:

AUD/USD 4hr: breakout target reached; the 61.8% fib for 180 pips!

Example EUR/USD April 2020: Note where price action paused after this trend line breakout (click on image for larger view):

Example GBP/USD March 2020: Note where price action paused after this triangle breakout (click twice on images for larger view):

- GBP/USD 4hr: pre b/o

- GBP/USD 4hr: b/o gives 750 pips.

Example NZD/USD March 2020: Note where price action paused after this triangle breakout (click twice on images for larger view):

- NZD/USD 4hr: pre b/o

- NZD/USD 4hr: after 290 pip b/o

Example USD/JPY March 2020: Note where price action paused after this triangle breakout:

USD/JPY 4hr: chart posted Friday morning; March 13th 2020:

USD/JPY 4hr: chart after the 200 pip b/o move:

Example LIT February 2020: What a classic descending wedge breakout this was! It took a few months but the 61.8% fib target has finally been reached!

LIT weekly: descending wedge b/o from Nov 2019:

LIT weekly: descending wedge target reached Feb 2020:

LIT weekly: March 2020 shows why taking profit at the 61.8% fib level is a good idea!

Example ORE February 2020: I am LONG ORE but noted in a Tweet January that the descending wedge breakout had paused wand was shaping up in a Flag. However, note where this pullback paused! Right at the 61.8% fib!

ORE 4hr: chart noted in a Tweet in January 2020:

ORE daily: look where price bounced! At the 61.8% fib!

Example December 31st 2019: Look where price action stalled on the Cable after breaking out from this wedge and bouncing up from the 1.30 S/R level! Right at the 61.8% fib level!

GBP/USD 4hr: breakout target of the 61.8% fib reached!

GBP/USD 4hr: price retreated after reaching the 61.8% fib:

Example December 4th 2019: This bullish-reversal descending wedge was posted in my weekend analysis on December 1st. Note where price action stalled after the breakout! Right at the 61.8% Fibonacci level.

AUD/USD 4hr: chart from analysis with wedge b/o trade idea:

AUD/USD 4hr: breakout target reached!

Example December 2019: A2M 4hr: This first chart was posted on Twitter on Nov 19th 2019. The 61.8% fib target was reached here by December 2nd:

A2M 4hr: from Twitter Nov 19th:

A2M 4hr: the 61.8% target reached Dec 2nd:

A2M daily:note how the 61.8% held through to Jan 2020:

Example November 26th 2019: ORE 15 min: this is a Lithium stock I am trading and look where the latest pullback stalled! Right at the 61.8% fib:

ORE 15 min: bounced right at the 61.8% fib!

Example October 27th 2019: BTC/USD daily: look where Bitcoin bounced! Right at the 61.8% fib level:

BTC/USD daily: bounced right at the daily 61.8% fib!

Example October 21st 2019: LLC weekly: This triangle breakout on Lend lease had the 61.8% fib level as the take profit target. It took five months but it finally reached this target level! The Breakout was at $13. The Target was $18. A $5 gain represented a 38% gain!

LLC weekly: the target of this April breakout was the weekly 61.8% fib!

LLC weekly: reached right up to the weekly 61.8% fib!

Example October 14th 2019: DMP weekly: Look where this pullback on Domino’s Pizza stalled. Right at the 61.8% fib level!

DMP weekly: stalled right at the weekly 61.8% fib!

Example September 16th 2019: TLT daily: I had warned about a potential Double Top brewing here back in August. Once the support trend line broke I warned to watch 144. After 144, the obvious target was the daily chart’s 61.8% fib and this where price headed! Note how price tested the 61.8% Fib level and then bounced right back up from there!

TLT daily: headed right down to the daily 61.8% fib!

TLT daily: bounced right back up from the daily 61.8% fib!

Example August 14th 2019: SPY daily: The pullback on trade war woes stalled right at the 61.8% fib:

SPY daily: stalled and then bounced right at the daily 61.8% fib:

Example July 2019: TNX weekly: Look where the 10-Year T-Note stalled! Right at the weekly 61.8% fib!

TNX weekly: turned right at the weekly 61.8% fib!

Example July 2019: IWC weekly: Look where the Small Caps ETF pulled back to! Right at the weekly 61.8% fib!

IWC weekly: turned right at the weekly 61.8% fib!

Example July 2019: Oil 4hr: Oil was trading in a 4hr chart triangle on July 16 th as shown below:

Oil 4hr: as of July 16th:

Oil 4hr: gave up to 370 pips by Fri July 19th but stalled at the 61.8% fib:

Example July 2019: AUD/USD 4hr: I had warned subscribers to watch for any make or break at the 61.8% fib and, look where price bounced!

AUD/USD 4hr: the warning was to watch the 61.8% fib for any bounce:

AUD/USD 4hr: note where price bounced:

Example July 2019: EWJ weekly: I came across this Japanese ETF chart today and noted, with interest, where price stopped in the recent pullback; the 61.8% fib!

EWJ weekly:

Example June 2019: KDR weekly: Kidman Resource broke out from this triangle in February 2019. Look where price action stalled! Right at the weekly 61.8% fib level:

KDR weekly: trend line b/o in February 2019:

KDR weekly: price stalled at 61.8% fib in June 2019:

Example June 2019: NZD/USD 4hr: this chart was show just prior to the June FOMC meeting and traders were warned to watch for any push to the 0.66 level as this was near the 4hr chart’s 61.8% fib:

NZD/USD 4hr:

Look where price pushed up to!

NZD/USD 4hr:

CSCO monthly: note how price action is struggling at this monthly 61.8% fib level:

AAPL: Apple weekly: note the respect of the 61.8% fib!

AAPL weekly:

MU: Micron Technology: this is one of my favourite stocks to trade and I’ve been doing so since the days when it was around $6, back around 2008. Check the monthly and weekly charts below to see how this stock seems to have great respect for the 61.8% Fibonacci level!

MU monthly:

MU weekly:

NEC weekly: June 2019: note where this bullish channel breakout stalled:

CAR weekly: June 2019: note where this bullish channel breakout stalled:

ASIA daily: June 2019: note where this ETF stalled:

RCII weekly: May 2019: this stock made a bullish wedge breakout and look where price action ended up hitting before stalling; the 61.8% Fibonacci level!

RCII weekly: new breakout in mid 2018:

RCII weekly: the 61.8% fib level reached in May 2019 before stalling:

RCII weekly: the 61.8% fib still proving tough resistance in Aug 2019:

Example: USDX May 2019: The US$ index had peaked at the key 98 level but subsequently pulled back. I had warned traders in my weekend analysis to watch for any pullback to the 4hr chart’s 61.8% fib level. The chart from this post is shown below:

USDX 4hr: from April 27th post:

Now, note where price pulled back to and where it actually bounced!

USDX 4hr: from May 5th post:

Example: AAPL March 2019: Apple stock experienced strong gains in March 2019 with the 61.8% fib, near $200 S/R, offering some resistance:

AAPL daily March 4th 2019 prior to breakout:

AAPL daily March 29th 2019 following breakout:

EXAMPLE: BBY weekly: this channel breakout came after a bounce off the 61.8% Fib level:

BBY weekly: after 61.8% fib bounce but prior to channel breakout:

BBY weekly: after channel breakout and bounce off 61.8% fib:

Example: IWC March 2019: this micros stock ETF pulled back and respected the 61.8% Fibonacci level after the 2016-2018 swing High move. It then pulled back to the 61.8% Fibonacci of the 2018-2019 swing Low move!

Pull back to the 61.8% Fibonacci level after the 2016-2018 swing High move:

Pull back to the 61.8% Fibonacci level after the 2018-2019 swing Low move:

Example: EBAY March 2019: Price action broke out of this triangle and the first main target was the 61.8% fib, near $40, that was reached in early March 2019:

EBAY weekly: pre breakout:

EBAY weekly: 61.8% fib reached:

EBAY weekly: price keeps peppering the 61.8% fib:

Example AMD Feb 2019: Price action broke out of this triangle and the first main target was the 61.8% fib, near $25:

AMD weekly: new breakout:

AMD weekly: 61.8% fib, circa $25, reached:

Example: MYE Feb 2019: Price action pulled back to the 61.8% fib before reversing here:

Example: KDR Feb 2019: Price action pulled back to the 61.8% fib and then paused to consolidate:

Example: GSC Feb 2019: Price action pulled back to the 61.8% fib and then paused to consolidate:

Example: EHL Feb 2019: Note where this pullback paused! Right at the 61.8% fib:

Example FMG Feb 2019: this descending wedge breakout pulled back right up to the 61.8% fib:

FMG weekly: shortly after b/o:

FMG weekly: 61.8% b/o: target achieved

Example: EEM: Feb 2019.

Note how price action pulled back to but respected the 61.8% fib region:

EEM weekly:

Example: USDX: Oct 2018.

I had warned my TC followers to watch the 95.70 and 4hr chart 61.8% fib for any potential pause with the US$ rally. This was certainly sage advice as the charts below reveal:

Before breakout:

After breakout: note the pause at 95.70 / 61.8 % fib:

Example: GBP/JPY: Aug 2018.

Note the pullback off the 61.8% fib for the GBP/JPY: click on charts to enlarge the view:

GBP/JPY 4hr: 30th Aug

GBP/JPY 4hr: 31st Aug

Example: Blackmores: BKL Jan 2018.

Note the respect of the weekly 61.8% fib for price action on BKL.

This was then followed up by another respect of a 61.8% Fib but, this time, it was of the 2107 swing high move!

Example: Oil June 2017.

Towards the end of May I noted the 61.8% Fibonacci level might be one to watch on the 4hr chart of Oil. Here was the chart from that post:

By the end of the next week this 61.8% Fib level had been tested and acted as support:

Example: Gold May 2017

On Tuesday May 16th I had warned traders to watch for any bounce with Gold to possibly test the 61.8% Fibonacci level on the 4hr chart. This was the chart from that post:

By Thursday May 18th price action had tested this key 61.8% Fib region:

The Friday 19th chart show how this 61.8% Fibonacci region proved to be effective resistance:

Example: USD/JPY May 2017

I’d mentioned to traders to watch the Flag brewing on the 4hr chart of the USD/JPY and that any breakdown might target the 61.8% Fibonacci level. This was the chart from that post:

This was the chart showing the breakout move and how the 61.8% Fibonacci did actually act as a target for price action and then offered support:

Example: EUR/USD April 2017

The EUR/USD had been ranging in a triangle pattern on the daily chart time frame during April 2017 but note how the ranging activity respected the 61.8% fib during this period:

Example: Apple Stock 2017

Apple stock has made a significant recovery off the lows experienced in 2009. Note how the first recovery period was followed by a pullback to the 50% Fibonacci level. The subsequent recovery after this lasted almost two years before it slowed and eventually pulled back. Note how this second pullback also retreated to and respected the 50% Fibonacci level though:

Example: USD/ZAR April 2017.

On Sunday 23rd April I was asked via Twitter about my thoughts on the USD/ZAR and I replied with the following chart noting that the 61.8% fib looked like a good target due to also being a zone of previous S/R:

This exchange of ideas was over the weekend of the French Election and, at market open on Monday 24th, the USD/ZAR had already fallen to test this 61/8% Fib region:

When I dropped down to check the 15 min chart I noticed that there had already been a TC LONG signal that had triggered on the previous Friday; late in the US session. How fortuitous this would have been as the gap at market open ended up giving a SHORT move worth 1,900 pips!

Checking this chart at the end of the week revealed that price action continued to bounce up from this 61.8% Fib region and this move, alone, gave over 4,000 pips:

Example: ASX-200 April 2017

Note the respect of the 61.8% fib on the ASX-200 Aussie stock index:

Example: EUR/JPY in April 2017

Note how the EUR/JPY respected the daily chart’s 61.8% fib whilst ranging within a larger triangle pattern:

Example: USD/TRY in April 2017

I had warned about the potential for the 61.8% fib to act as support here in a post I wrote on April 13th 2017. Price had retreated from a bear trend line and reached down to the 61.8% Fibonacci level of this recent swing high move as seen in the chart below:

This screen shot was taken the following day and note how the 61.8% Fib level did indeed act as support not once, but twice!

Example: EUR/JPY trade in September 2015

Sept 8th 2015: I wrote an article on Sept 8th suggesting traders watch price action for any close and hold above 134 to possibly target the 136 region as this hugely congested with a number of potential resistance levels. It was the region of the previously broken triangle trend line, the monthly pivot, the 61.8% fib of the recent swing low move and 4hr 200 EMA. This was how the chart appeared at this time:

Sept 11th 2015:

Sat Sept 12th: the target area was reached and offered some resistance but price eventually continued higher. There were 200 pips on offer though in the move from 134 to 136 and even just a section of this move would have been profitable!

E/J monthly cloud:

Tue Sept 15th: Price action did eventually react at the congested resistance zone near 136 and pulled back lower:

Example: USD/CAD trade September 2014 – 2015:

Yes you read correctly! This trade took over one year to complete but, in doing so, delivered over 2,500 pips! I noted a monthly chart triangle pattern back in September 2014 and the post with this chart and description can be found through the following link. A copy of how the chart appeared back then is copied below:

In this post article I explained that, whilst I was looking for a triangle breakout trade, the confluence came from the fact that the triangle breakout target overlapped with the monthly chart’s 61.8% fib of the major 2002-2007 swing low move. It was here that I suggested the target for any breakout move would be worth 2,500 pips and would be at this 61.8% Fibonacci level.

This trade completed with the full 2,500 pip move right up to this 61.8% fib target in September 2015 and was described in a post found through this link. The chart from that post is copied below:

The benefit of the 61.8% Fibonacci level did not end there though. I had warned that any Fibonacci pullback might target the previous S/R level down near 1.30 and this would have been a move worth over 400 pips. This 61.8% Fib pullback move to the 1.30 level evolved, to the pip, on October 10th and the chart showing this move is copied below:

Thus, this 61.8% fib level enabled a 2,500 pip move upwards and then a 400 pip move down to test 1.30 for a total of 2,900 pips!

Example: Telstra TLS, an ASX stock September 2015:

Stocks often display a similar respect of Fibonacci and the larger traded stocks even more-so. Telstra is a popularly traded Aussie stock and is quite liquid with volumes around 5 million per day. This recently put in a high right on the 61.8% fib level:

TLS monthly: respecting the 61.8% fib level:

Example: ANZ, an ASX stock; April 2017.

ANZ Bank has struggled for the last few weeks at the 61.8% Fibonacci level of the recent swing low move:

This 61.8% fib was up near previous S/R of $32 and I had this as the potential target when price initially broke out of the descending channel in mid 2016, as per the chart below:

Example: Blackmores BKL, an ASX stock: April 2017.

Blackmores stock has been a huge success story increasing from $40 to $220 during 2015. Since that time though price action has pulled back and the herd mentality has drawn it down to the 61.8% Fibonacci region. The stock has hovered above this 61.8% fib but under $120 resistance for the last seven months.

October 2017 update: the 61.8% Fib level held and price has raced higher from the 4100 level up to $160:

Example: Evolution Mining EVN, an ASX stock: April 2017.

Evolution mining broke up and out from a triangle during 2015 and I captured the move a bit after this here:

Note where this bullish rally stalled though! At the 61.8% Fibonacci level near the whole-number $3 level:

Example: Village Road Show VRL, an ASX stock: April 2017 & updated Feb 2018.

The pullback on this stock paused at the 61.8% Fibonacci so I’ll be keen to see if this level holds from here. As at February 2018 price is still holding at this major fib support:

Example: Western Digital WDC, a NASDAQ stock. April 2017.

Back in December 2016 I had snapped this WDC chart and noted that any bullish continuation, following the triangle breakout, might target the 61.8% Fibonacci as this was a also previous S/R region near the $85 level.

Note how, four months later, price action has stalled at the 61.8% Fibonacci level

Ones to watch: I’m keeping an eye on the following charts to see if price action heads to test the noted Fibonacci levels.

Example: Telstra TLS, an ASX stock: April 2017.

This is a very popularly traded Aussie stock and I have been watching this chart since it respected a monthly 61.8% Fibonacci resistance level and began its pullback (this example was discussed in the section above). Now price has reached down to the weekly chart’s 61.8% Fibonacci retracement and potential support level so I’ll be watching to see if it might bounce from here. The latest weekly candle was a bullish-reversal ‘Hammer’ candle for some extra confluence here:

Example: Mt Gibson Iron MGX, an ASX stock: April 2017.

I’m going to keep an eye on this stock as I would expect any bullish continuation, following the triangle breakout, to target the previous S/R region near $2.50 as this is also near the 61.8% Fibonacci level. We’ll see if this ever evolves!

Example: Monadelphous Group MND, an ASX stock: April 2017.

This is another stock that I would be watching for any bullish follow-through to target previous S/R near $20 as this is also near the 61.8% Fibonacci level:

December 2017 Update: the $20 target near the 61.8% fib has been reached for a 43% gain:

Example: Oz Minerals OZL, an ASX stock. April 2017.

This is another stock where, if it can break and hold above $10, then I’d be watching for any continuation move to target the previous S/R level of $25 as this is also near the 61.8% Fibonacci level.

Example: St Barbara SBM, an ASX stock: April 2017.

This is another stock that has made a bullish triangle breakout and I’ll be watching for any continuation to test the $9 S/R region as this is also near the 61.8% Fibonacci level.

Example: Deutsche Bank DB an NYSE stock: April 2017.

Price action is currently within a bullish-reversal descending wedge and so I’ll be watching to see if any bullish breakout heads up to test previous S/R at $80 that is also near the 61.8% Fibonacci.

Example: Macy’s M, an NYSE stock: April 2017.

I’ll be watching to see if the 61.8% Fibonacci region, near the $30 S/R level, can act as support here:

NB: I will load more examples onto this page as they become available.

Questions: Please address any questions to: mary@tradecharting.com